*Mr. Cuban may receive financial compensation for his support.

Last updated: April 24, 2024

Ready to start a Connecticut LLC? Setting up shop in the Nutmeg State comes with its unique blend of excitement and responsibilities. But before you officially roll out your entrepreneurial dream, there’s some legal groundwork to be done. And what’s a better way to protect your personal assets than establishing a limited liability company (LLC)?

In this guide, we’ll simplify the journey of establishing a Connecticut LLC, highlighting each vital step along the way. Keep in mind, we’re diving into the world of domestic LLCs — so if you’re on the hunt for insights on a foreign (out-of-state) LLC or professional limited liability company (PLLC), this isn’t your stop.

How to Start an LLC in CT

Ready to join the Connecticut business club? To kickstart your LLC, make your way to the Business Services wing of the Connecticut Secretary of State’s palace. Begin with christening your LLC with a name that echoes louder than the cheers at a UConn game. Next, appoint your trusty registered agent and submit your Certificate of Organization. We’ll also explain why an operating agreement is the unsung hero of LLCs and guide you on obtaining an Employer Identification Number (EIN) from the IRS.

To make your Connecticut LLC formation process as smooth as its famous clam chowder, we’ve crafted this step-by-step guide. And if you’ve got burning questions about initiating your LLC adventure here, rest assured, we’ve got your back.

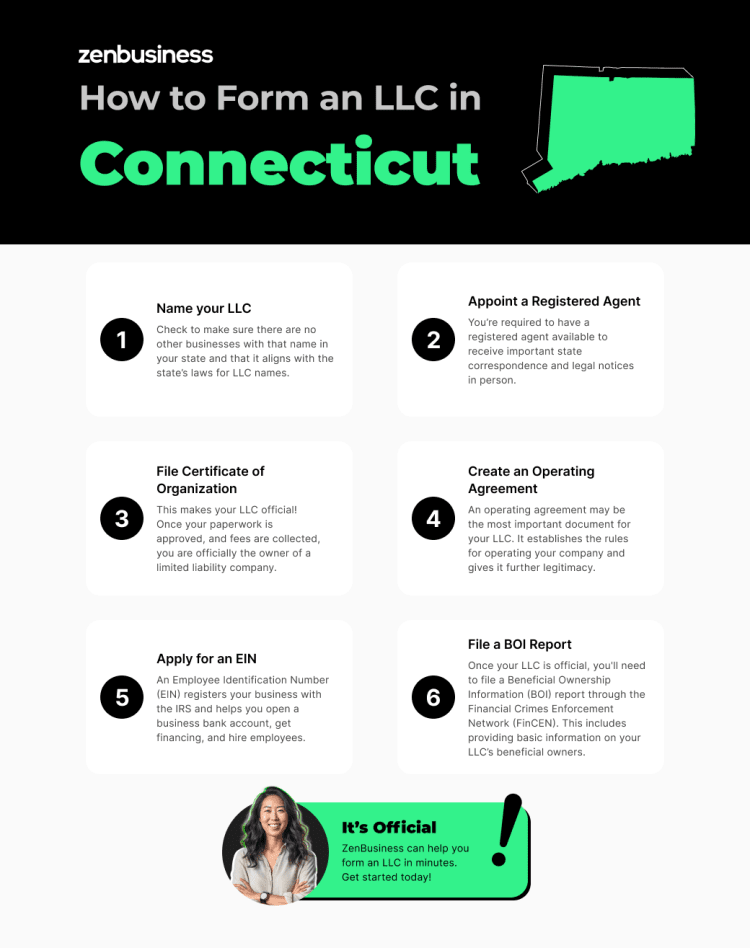

- Name your Connecticut LLC

- Appoint a registered agent in Connecticut

- File a Connecticut LLC Certificate of Organization

- Create a Connecticut LLC operating agreement

- Apply for an EIN

- File your LLC’s BOI report

Step 1: Name your Connecticut LLC

Find a unique name for your company. The first step in creating an LLC in Connecticut is coming up with a name for your business. Your limited liability company name must be unique in the state of Connecticut.

The CT Secretary of State website has a search engine that can tell you whether your desired name is available. We walk you through this process on our Connecticut Business Entity Search page.

Available Business Name Reservation

If the name you choose is available but you’re not ready to file your Connecticut LLC paperwork, you may want to reserve it with the Secretary of State. The Connecticut Secretary of State allows you to reserve a business name for 120 days for a fee.

Required Words and Naming Guidelines

An LLC in Connecticut must have a name that ends with the words “Limited Liability Company” or the abbreviations “LLC” or “L.L.C.” to comply with state law. Additionally, “Limited” may be abbreviated as “Ltd.,” and “company” may be abbreviated as “Co.”

According to Connecticut LLC naming guidelines, nothing in the LLC’s name can state or imply that the business’s purpose is different from the stated purpose in the LLC’s Certificate of Organization.

Beyond that, you need to check that your name is unique. Like we mentioned earlier, you’ll need to run a Connecticut business name search. It’s also recommended to search your name against the United States Patent and Trademark Office website, and then do another search against the Connecticut trademark database as well. A basic web search is also a good idea.

This way, you can help ensure that your name is unique so your business can stand out.

Secure a domain name for your Connecticut LLC

You may also want to check to see if your desired domain name is available. While many top-level domains exist — “.co,” “.net,” etc. — there’s nothing like getting “.com” to give some legitimacy to your business. We have a tool to help you do a preliminary domain name search. Our domain name registration service can help you secure the online name that will best serve your Connecticut limited liability company.

Federal and State Trademarks

Even if the Secretary of State approves your business name, that’s no guarantee that someone else hasn’t already claimed it with a federal or state trademark. To truly check to see if your business name isn’t trademarked is difficult because there’s no central place to check. Some businesses even employ an attorney specializing in trademarks to see if they’re in the clear.

You can take some measures yourself, like searching the trademark database on the United States Patent and Trademark Office website. This can help you determine if someone’s already claimed a federal trademark on the name you want.

State trademarks are applicable only within the borders of a state. To find out if your desired name has been trademarked at the state level, Connecticut has a Trade and Service Mark Records Search page. If you want, you can also apply for your own state trademark by completing an application and paying a fee.

In addition to checking these databases, it’s wise to do extensive internet searches for your business name, including domain names and social media sites.

DBA Name for Your Business in Connecticut

If you intend to operate your business under a name different from its legal name, you’ll need a DBA or “doing business as” name. A Connecticut DBA is another name to use for your business. They are often used when a company wants to rebrand for a new product line or store. This will also need to be registered with the clerk in the town or city where business is transacted.

Ready to Start Your Connecticut LLC?

Enter your desired business name to get started

Step 2: Appoint a registered agent in Connecticut

Name a registered agent for your business. Connecticut business law requires every LLC to have a registered agent for service of process. Registered agents physically accept correspondence from the Connecticut Secretary of State and any court papers (such as subpoenas) on the company’s behalf.

Your registered agent is an individual or business entity authorized to do business in Connecticut. If the agent is an individual, they must be a resident of the state of Connecticut. In either case, the agent must have a physical street address within the state. A P.O. box won’t do.

The Benefits of Using a Registered Agent Service

Many new LLC owners (called “members” in an LLC) think they should be their company’s registered agent and use their business’s primary location as the registered office address. However, this approach may have unintended consequences.

Some benefits of hiring an outside registered agent service such as ours include:

- A service of process, for example, won’t be delivered to you in front of customers if you have an outside registered agent service in Connecticut.

- When you serve as the agent for your LLC in Connecticut, you’re required to be available during standard business hours. If you plan to work outside the office or take business trips, this requirement could be problematic.

- If you provide your personal or business address as your registered agent address, you’ll need to update your Connecticut registered agent paperwork with the state each time you move. At rapidly growing companies, it’s easy to see how this essential step could get overlooked.

Step 3: File a Connecticut LLC Certificate of Organization

File your LLC paperwork with the state. A Certificate of Organization is a document that, once approved, makes your business a legal LLC in the state. You’ll need to complete the form, pay a filing fee, and submit it to the Secretary of State.

Filing official government documents like this can be intimidating for many people, which is why we’re here. With our business formation plans, we handle the filing for your LLC in Connecticut to make sure it’s done quickly the first time. But, although we can handle this for you, we’ll show you how the process works below.

Submit paperwork to the Connecticut Secretary of State

To create your LLC in Connecticut, you’ll need to file a Certificate of Organization with the Connecticut Secretary of State and pay a filing fee. You can submit the paperwork by mail or online. To complete the documents, you’ll need to know the following information:

- The name and address of your LLC and the LLC’s organizer

- The name and address of the company’s registered agent. If filing online, you’ll also need an email address for the agent. Connecticut requires that the person/entity being appointed consents to being the agent.

- The name and address of at least one manager or member

- The LLC’s email address, if available

For those who choose to mail their Certificate of Organization, send it to:

Business Service Division, Connecticut Secretary of the State

P.O. Box 150470

Hartford, CT 06115

If you have us handle filing your Certificate of Organization, once the state approves your LLC, your paperwork will be available from your ZenBusiness dashboard, where you can keep it and other important paperwork digitally organized.

Once you get your physical paperwork back from the state approving your new LLC, you’ll want to keep it in a safe location along with your other important documents, such as your operating agreement, member certificates, contracts, compliance checklists, transfer ledger, etc. We offer a customized business kit to help you keep these important documents organized and looking professional.

Step 4: Create a Connecticut LLC operating agreement

Write your LLC’s operating agreement. Much like the bylaws required by corporations, operating agreements outline the rules and procedures for the management of the LLC. However, unlike corporations, LLCs can do more to customize their internal practices to fit the needs of the business.

If you don’t draft an LLC operating agreement in Connecticut, background state law applies to your company. Typical concepts in an operating agreement include:

- Procedures for admitting or removing LLC members

- Allocation of profits and ownership

- Management structure and voting requirements

- Dissolution and winding up of the LLC

Once it’s completed and signed, the Connecticut LLC operating agreement should be kept in a secure location with other important business formation information. You don’t need to file it with the state.

If you’re unsure as to how to start creating an agreement for your Connecticut LLC, we offer a customizable operating agreement template to save you time researching and crafting the agreement yourself.

Step 5: Apply for an EIN

Get an Employer Identification Number. Your LLC needs an Internal Revenue Service (IRS) Employer Identification Number (EIN) unless your business is a single-member LLC with no employees (and sometimes even then). Plus, you’ll typically need an EIN if you want to open a business bank account or apply for a company credit card.

You can get your LLC’s EIN through the IRS website, by mail, or by fax. However, if you’re not fond of dealing with that particular government agency, we can get it for you. Our EIN service is quick and eliminates the hassle.

After Setting Up Your LLC in Connecticut

Following the establishment of your LLC in Connecticut, it’s essential to undertake a series of steps to ensure that your business is fully operational and adheres to state regulations. These steps are critical in laying a strong foundation for your business’s success and legal compliance.

Understand tax obligations

Taxes are an unavoidable part of running a business. By default, LLCs are taxed like pass-through entities, meaning that the LLC itself doesn’t pay taxes at the business level. Instead, the owners report their share of the profits on their personal tax returns. Some LLCs can also elect S corporation status or C corporation status to get breaks on self-employment taxes. The luxury of the LLC is that you can choose the option that works best for your business.

In Connecticut, this process repeats on the state level for business income. But there are a few other state tax obligations to consider.

Register with the Connecticut Department of Revenue Services

If your company has employees or collects sales tax, you may need to register your LLC with the Connecticut Department of Revenue Services. To see a full list of reasons you may need to register, visit the Department of Revenue Services Registration page. The registration fee depends on which type of business you operate.

Get business licenses and permits

Depending on the type of services or products you are offering, your LLC may be required to obtain licenses and/or permits. Connecticut doesn’t require a general business license at the state level, but some counties and municipalities require one.

Connecticut has an extensive list of professions and occupations that require business licenses. Different industries require different business licenses. You can visit the Connecticut Department of Consumer Protection to help understand what your business will require at the state level, but remember that licensing and permitting also happen at the federal and local levels and vary across industries, so you’ll need to do some research to find out what your business needs.

If all that research sounds like a hassle, we recommend using our business license report, which will provide you with a comprehensive report of all the licenses and permits required for your LLC.

Open a business bank account for your Connecticut LLC

Once you’ve secured an EIN, you’ll be able to open a business bank account. Having separate accounts for your business and your personal banking is critical for sorting out your finances at tax time and helps you avoid commingling funds.

Commingling funds can not only make your taxes more difficult, but it could also be used against you if someone takes you to court to challenge whether you and your LLC are truly separate entities (that is, they want to sue you for not just your business assets, but also your personal assets).

We offer a discounted bank account for your new business. This allows for unlimited transactions, online banking, a debit card, and more. When you want to authorize others in your business to use the account, we offer a banking resolution template to simplify the process.

For further help managing your new business’s finances, try ZenBusiness Money. It can help you create invoices, receive payments, transfer money, and manage clients all in one place.

Set up an accounting system

Establishing a robust accounting system is key to managing your LLC’s finances. This system will track your revenue and expenses and help in preparing financial statements. It’s important for budgeting, tax preparation, and financial planning.

You can opt for accounting software that caters to small businesses, consider hiring a professional accountant or bookkeeper, or use our ZenBusiness app. Keeping accurate and organized financial records will not only help keep you compliant with tax laws but also provide valuable insights into your business’s financial health.

Stay informed about legal requirements

Staying informed about ongoing legal and tax requirements is crucial for maintaining your LLC’s compliance in Connecticut. This includes understanding the state’s taxation requirements, employment laws if you have employees, and any industry-specific regulations.

These laws can change at any time, so it can be helpful to consult with a Connecticut legal professional on a regular basis to stay informed.

Taking these steps diligently after setting up your LLC in Connecticut will help ensure that your business operates efficiently, remains in legal compliance, and is positioned for growth and success.

File annual reports

Each Connecticut LLC must regularly file an annual report with the Connecticut Secretary of State. Your Connecticut annual report comes with a filing fee and must be filed online. You must file the annual report between January 1 and March 31 each year. If you don’t file your annual report in a timely manner, the Connecticut Secretary of State may dissolve your LLC.

We can help you with your annual report in a couple of ways. Our annual report service will help you file your annual report, and our Worry-Free Compliance service not only helps with filing your annual report but also helps you with two amendment filings each year.

Step 6: Submit your LLC’s beneficial ownership information report

After Connecticut approves your Certificate of Organization, you have another requirement to fulfill: submitting a beneficial ownership information report, or BOI report. This report was introduced by the Corporate Transparency Act, which aims to reduce fraud and other financial crimes by making it more difficult to hide illicit activities behind shell companies.

To do that, the act requires businesses to disclose information about their beneficial owners. According to the act’s terms, a beneficial owner is anyone who holds 25% or more of your LLC’s ownership interest, exercises substantial control over it, or gains significant economic benefit from its assets. For all of your beneficial owners you will need to provide their name, address, and identifying information.

You’ll report this information online or through a PDF upload on the Financial Crimes Enforcement Network’s website (FinCEN). It’s free to file, and there’s no state version of the form. Failure to file carries severe civil and criminal penalties, so be sure to file on time. For LLCs created in 2024, the due date is within 90 days of getting your Certificate of Organization approved by Connecticut. LLCs created in 2025 and beyond will have just 30 days. Any LLCs that organized prior to 2024 have until January 1, 2025, to file.

For more information about the BOI, check out FinCEN’s website. And if you’d like help handling this new filing, our BOI report filing service has you covered.

LLC State Filing Fees in Connecticut

When forming an LLC in Connecticut, there are several fees involved.

- Filing Fee for Certificate of Organization: $120

- Registered Agent Service Fee: varies, but $100 to $300 annually is common

- Annual Report Filing Fee: $80 (plus late fees, if applicable)

These fees are subject to change, so it’s always a good idea to check the most current information.

Other Types of Businesses in Connecticut

A Connecticut LLC isn’t your only option. While the LLC is a popular choice for many small business owners, there are other types to choose from. Here are some business entity types you can consider.

Sole Proprietorship

Sole proprietorships are unincorporated business entities owned by a single person. They are easy to start and run (requiring no registration paperwork and minimal upkeep). However, the downside is that sole proprietors lack any personal asset protection. The owner’s personal assets could be compromised in the event of a lawsuit.

Partnership

Partnerships are similar to sole proprietorships, but they’re owned by two or more people. Like sole proprietorships, traditional partnerships don’t have personal asset protection, but they’re easy to start and run. Partnerships are governed by a partnership agreement.

One quick note: there are different types of partnerships, including limited partnerships, limited liability partnerships, and general partnerships. While some partnerships offer liability protection, not all of them do, and their protections aren’t as robust as LLCs.

Corporation

A corporation is somewhat similar to an LLC because it offers personal asset protection for its owners. But the real draw of a corporation is that a corporation can raise capital by issuing shares of stock.

Compared to LLCs, corporations make it easier to raise capital, but they require more formal upkeep and ongoing paperwork requirements.

Need help forming your LLC in CT?

We offer fast, accurate Connecticut LLC formation online, starting at $0. Our services provide long-term business support to help you start, run, and grow your business.

So, whether you’re starting a barbershop in Bridgeford or a dog walking service in Bristol, we can reduce your stress. Let us take care of formation, compliance, and more. That way, you can get back to running your dream business.

Related Topics

CT LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

Connecticut LLC FAQs

-

The state fees for forming a Connecticut LLC can range from $120 to $180, depending on factors such as whether you choose to reserve your business name. Note that fees change over time, so check the Connecticut Secretary of State’s website for the most recent fee schedule.

Each year, you’ll also be required to pay a fee with your LLC annual report. Your business may need to pay additional fees for permits and licenses.

-

Depending on the type of services or products you are offering, your LLC may be required to obtain licenses and/or permits. Connecticut doesn’t require a general business license at the state level, but some counties and municipalities require one.

Connecticut has an extensive list of professions and occupations that require business licenses. Different industries require different business licenses. You can visit the Connecticut Department of Consumer Protection to help understand what your business will require at the state level, but remember that licensing and permitting also happen at the federal and local levels and vary across industries, so you’ll need to do some research to find out what your business needs.

If all that research sounds like a hassle, we recommend using our business license report, which will provide you with a comprehensive report of all the licenses and permits required for your LLC.

-

The benefits of forming a Connecticut LLC include:

- Separating your personal liabilities and personal assets from your business debts and obligations.

- Quick and simple filing, management, compliance, and administration of your Connecticut LLC.

- Easy tax filing and potential tax advantages.

-

By default, LLCs are exempt from double taxation. This means you’ll only pay business income taxes on your LLC profits when filing your personal tax return versus paying taxes on both your corporate tax return and your personal tax return.

Of course, there are other tax requirements you’ll need to be aware of. LLCs in Connecticut are subject to an annual Connecticut Business Entity Tax if they’re required to file an annual report with the Connecticut Secretary of the State.

See the Connecticut Department of Revenue Services website for more information on the taxes your LLC will be responsible for. An experienced accountant or tax specialist can also help you make the best tax decisions and keep your business tax-compliant. -

If you file a paper application, processing usually takes seven to 10 business days. However, if the Secretary of State is busy, it could take up to several weeks. If you file online, you’ll typically have your Certificate of Organization processed in two to three days.

You can also expedite your order for an additional fee.

-

You don’t need to file your operating agreement, but you should keep it on file for future reference. Connecticut doesn’t require LLCs to draft or adopt an operating agreement. However, some states do legally require LLCs to have an operating agreement.

-

When you get an EIN, you’ll be informed of the available tax classification options. Most LLCs elect pass-through taxation, where the LLC’s members are only taxed once on their earnings.

But if you meet the IRS criteria, you could also have your LLC taxed as an S corporation. For some LLCs, this can decrease the amount of taxes the members would pay for Social Security and Medicare.

Alternatively, you can have your limited liability company taxed as a C corporation. A C corporation can take advantage of the widest range of deductions, but this is usually advisable only for much larger and more profitable LLCs.

A qualified tax professional can advise you as to which tax status makes the most sense for your LLC.

-

No, Connecticut doesn’t currently permit Series LLCs. A Series LLC has multiple series of members, managers, or LLC interests, each having separate rights, powers, or duties from members in other series of the same LLC.

Each series may also have a distinct business purpose and segregate its liability from the other series in the LLC.

-

You’ll need to make sure your LLC has all the licenses and permits it’s required to have by law. Unfortunately, because licensing varies by industry and location and can occur on the federal, state, and local levels, there’s no central place to check to see if you have all the licenses and permits you need. You’ll have to do some research.

If you don’t have the time or inclination to do all this research, or if you just want the peace of mind to know that your business has all the licenses and permits it’s legally required to have, our license report service can do the work for you. -

Before starting the dissolution process, the members of an LLC should vote to dissolve it. For the subsequent steps please refer to our Connecticut business dissolution guide.

-

Yes, you can use an LLC registered in a different state (foreign LLC) to conduct business in Connecticut after you file a Foreign Registration Statement.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near Connecticut

Ready to Start Your LLC?