*Mr. Cuban may receive financial compensation for his support.

Last Updated: April 24, 2024

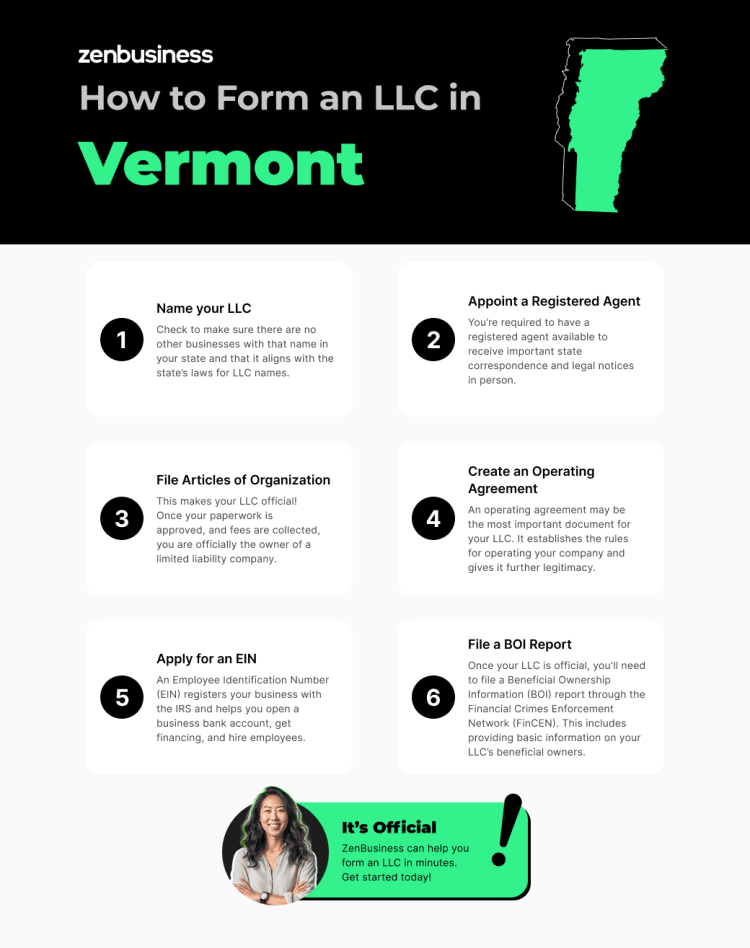

How to Start an LLC in Vermont

Once you’ve decided to create an LLC, Vermont has some basic filing rules. To be as prepared as possible to start a Vermont LLC, you’ll want to gather your basic business information to have on hand. But first, let’s get into the business formation steps required by the Vermont Department of State. We’ll discuss each one below.

- Name your Vermont LLC

- Appoint a registered agent in Vermont

- File Vermont Articles of Organization

- Create an operating agreement for your Vermont LLC

- Apply for an EIN

- File a BOI report

Vermont — land of artisanal cheese, Bernie’s mittens, and now, potentially, your new Vermont LLC. If you think choosing the perfect local IPA is a challenge, try deciphering the labyrinthine paths of Vermont’s LLC laws. It’s akin to navigating a Vermont backroad in mud season: confusing, messy, and a bit stressful.

But don’t pack up your flannels and maple syrup just yet. We’re here to serve as your GPS through the Green Mountain State’s business formation terrain. Our guide will elucidate the quirks of starting an LLC in Vermont faster than you can say “Champlain Lake sunset.”

Besides this handy guide, our services are designed to assist budding entrepreneurs like you to not only start but also efficiently run and grow your Vermont limited liability company, ensuring it thrives like Vermont maple trees in spring.

To be clear, this guide is for those who aim to start a domestic LLC, that is, an LLC concocted right here in Vermont’s fertile business soil. If you’re starting a foreign LLC (one created in another state), a professional limited liability company (PLLC), or any other type of LLC, you’ll need a separate guide.

Step 1: Name your Vermont LLC

Choose a unique name. To register a business in Vermont, you need to decide what to name your LLC. One of the most important parts of forming an LLC in VT is to choose a name that will describe your business and help you stand out from other businesses like it. Selecting a name for your LLC is also the first step required to register a business in VT.

Search VT LLC business names

When you start a Vermont LLC, the Secretary of State’s rules say you need to have a unique name. That means you’ll need to search all the other business names in Vermont to make sure the one you picked is different. Our VT business search page can help. You should also run a similar search with the United States Patent and Trademark Office to ensure your name doesn’t infringe on federally protected trademarks; you’ll want to do the same for Vermont state trademarks. With these sites, bear in mind that slight changes in wording (such as using different articles or abbreviations) are usually not enough to make a name distinguishable from another.

The Secretary of State also has a few rules about what needs to go into your business name. Those rules include:

- You must use a “designator” at the end of the name to indicate that your business is an LLC. This can be one of the following phrases or abbreviations: “Limited Liability Company,” “LLC,” “Ltd. Liability Co.,” “Limited Company,” “LC,” or “Ltd. Co.”

- You can’t use discriminatory, indecent, or obscene language or words that could deceive the public.

You may want to review Vermont’s naming guidelines, since being well-prepared is the best way to start an LLC in Vermont.

Get a matching domain name for your LLC in Vermont

As you search for available business names, check if relevant domain names are available for those business names. A website is an affordable marketing tool that can drive customers to your business. You want a domain that aligns with your LLC name, making the website easy for search engines to find. Check out our domain name registration and domain name search services for more information.

Reserving a Business Name

If you’ve come up with the perfect name but haven’t ironed out the details for filing your Articles of Organization, that’s okay. You have the option to get an LLC name reserved. Filing online to reserve your chosen LLC Vermont name holds the name for 120 days for a fee.

Ready to Start Your Vermont LLC?

Enter your desired business name to get started

Step 2: Appoint a registered agent in Vermont

Name a registered agent for your business. Next, you’ll need to choose a registered agent for your LLC in VT. A “registered agent” is someone who is authorized to receive legal notices and certain state correspondence on behalf of your business.

A Vermont registered agent can be an individual, a business, or a nonprofit with a physical street address in Vermont — no P.O. boxes are allowed. Vermont requires that all LLCs have a registered agent. You’ll need to identify them on the VT LLC form you file with the Secretary of State.

Vermont Registered Agent Requirements

Vermont has simple but specific requirements about who can serve as a registered agent. Under state law, the agent must:

- Be an individual resident of the state OR a business with authority to do business in the state

- Have a physical street address in Vermont (no P.O. boxes)

- Be present at that address during all regular business hours

Under those criteria, small business owners have found three popular choices for appointing a registered agent: serving as their own registered agent, appointing a friend or family member, or hiring a service like ours.

Hiring a Registered Agent Service

It’s highly recommended to hire a registered agent service instead of being your own or asking someone you know. Granted, you will incur a little extra expense, but hiring an agent has significant advantages:

- Helps ensure you stay organized and never miss an important notice

- Frees you up to run errands, take vacation and sick days, and be away from your registered office address during regular business hours

- Guarantees a process server can always find your agent, protecting your ability to defend yourself in court

- Lets you change your business location without filing extra paperwork with the Corporations Division

- Prevents embarrassment by ensuring you never receive notice about a lawsuit against you in front of a customer, business partner, or employee

Ultimately, hiring a service can make your life easier. Our registered agent services can help keep your Vermont business registration compliant by connecting you with a registered agent. Our Vermont registered agent service ensures that someone will be available to receive important legal, tax, and other notices from the state.

Step 3: File Vermont Articles of Organization

File your LLC paperwork with the state. The third step is to file your Articles of Organization with the Secretary of State. You can do this online via the Vermont’s Online Business Service Center. You’ll also need to pay a filing fee of $125.

We understand that when you go to register a business in VT, it can be intimidating, especially for first-time entrepreneurs. That’s why we offer business formation plans to help you feel confident and get the paperwork done correctly. That being the case, we’ll still go over the steps below.

Information Needed for Vermont Articles of Organization

Have the following information on hand before you complete your Articles of Organization:

- Your chosen business name

- The registered agent’s name and contact details

- The LLC’s address

- The type of LLC you’re forming (regular, professional, or low-profit)

- The end of your LLC’s fiscal year

- A business description using your NAICS code

- The names of the members (owners) of the LLC

Having this information handy can make getting your documents completed easier. You can also purchase our Expedited Filing Service for a small fee. While this doesn’t impact how quickly the State of Vermont will process your documents, it helps us prioritize your LLC.

Amending Your Articles of Organization

You’ll need to file your Articles of Organization only once. If you end up making any changes down the road, you can file Vermont Articles of Amendment with the Vermont Secretary of State, along with a fee. If you do need to file an amendment, we have an amendment filing service that can handle it for you as well as our Worry-Free Compliance service, which includes two amendment filings every year.

If you file with us, we’ll help you keep all of your documents organized in an accessible digital dashboard.

Can I delay my LLC filing date?

Delaying your filing can be a smart choice for investors who start businesses near the end of a calendar year. This can spare your business the hassle of filing taxes for only a short period of the current year, particularly if you don’t anticipate sales or other business activity. Currently, Vermont lets you delay your filing date up to 90 days.

Step 4: Create an operating agreement for your Vermont LLC

Compose an LLC operating agreement. Next, you’ll want to create a Vermont operating agreement. This agreement isn’t required by law, nor do you need to file it with the state. However, an operating agreement is a governance tool for your small business that spells out how your business will be organized and operated.

Operating agreements allow you to set the rules and regulations for your LLC (within reason and in alignment with state laws), so most companies prefer them to relying on one-size-fits-all state LLC laws when resolving internal disputes. Having a written agreement can make your company more attractive to potential investors, too.

Benefits of Vermont LLC Operating Agreements

Operating agreements include a lot of crucial business details and procedures, which ultimately creates a lot of benefits. The benefits of having an operating agreement in place include:

- Preventing disputes: A good agreement details the rights and responsibilities of each member, along with how profits will be distributed. It also includes a procedure for resolving any disputes, adding rationality to any future disagreements.

- Setting up your management structure: An agreement can dictate whether the business will be a member-managed LLC (run by the owners) or a manager-managed LLC (run by managers who were appointed by the owners). Prescribing how the LLC is managed will help set the business up for smooth operation.

- Maintaining personal asset protections: A written agreement helps prove that you are treating your LLC as a separate legal entity, solidifying your personal liability protections. This is the main reason we recommend writing an agreement even if you’re a single-member LLC.

- Planning for the future: A good agreement explains how to add or remove members, how the business will be passed on if you die or are incapacitated, how to dissolve the LLC, and so on.

Ultimately, an LLC’s written agreement is beneficial because it puts a proactive procedure in place for issues that could arise down the line. If you’re not sure how to get started, our customizable template can help.

Step 5: Apply for an EIN

Get an Employer Identification Number (EIN). Once your VT LLC is formed, you can apply for your EIN. Also known as a Federal Employer Identification Number (FEIN) or Federal Tax Identification Number, an EIN is a number granted by the Internal Revenue Service (IRS). It’s like a Social Security number for your business. You’ll likely need an EIN before you can hire employees, apply for a business bank account, and pay taxes.

It’s possible to file for your LLC’s EIN through the IRS website, by mail, or by fax. But to save you time, we can get it for you. Our EIN Service lets you run your business while we deal with the IRS. We can also help you get a discounted bank account, and our ZenBusiness Money platform can help you manage your finances, make invoices, and more.

Register for Vermont business and payroll taxes

They say that one of the only things that’s certain in life is taxes, and that’s true with your LLC, as well. You’ll need to register your business with the VT Department of Taxes. You can do so online. Once you’re on the website, you can follow the instructions to open an account and register your business.

If you hire employees, you’ll need to register for payroll taxes, pay unemployment tax, and provide workers’ compensation insurance for your employees. You’ll be able to pay your taxes through this account, as well.

Can filing as an S corp lower my taxes?

Potentially, yes. But not always. The luxury of an LLC is that you can pick the taxation structure that works best for you. By default, you’re taxed like a pass-through entity, meaning the business itself doesn’t pay taxes at the business level. The members pay taxes on their personal returns instead.

However, LLCs can opt to be taxed like C corporations or S corporations instead. Typically, businesses do this to take advantage of tax breaks through deductions or reducing the burden of self-employment taxes. S corporations are especially helpful for minimizing self-employment tax.

For some LLCs (but not all) S corporation status is quite advantageous. If you’re considering changing your tax status, we highly recommend talking with a Vermont tax attorney for custom advice.

Manage your VT LLC’s finances and payments

We offer a discounted bank account for your new business. Our online banking system allows for transactions, online banking, a debit card, and more. When you want to authorize others in your business to use the account, we offer a banking resolution template to simplify the process.

For further help managing your new business’s finances, try ZenBusiness Money. Our app can help you create invoices, receive payments, transfer money, and manage clients all in one place.

Step 6: File your LLC’s beneficial ownership information report

The Corporate Transparency Act introduced a new requirement for LLCs and other small businesses in 2024: a beneficial ownership information report. When you file this report, you’ll provide the names, addresses, and identifying documents for each of your LLC’s beneficial owners, giving this information to the Financial Crimes Enforcement Network (FinCEN).

According to the act, a beneficial owner is anyone who exercises substantial control over your LLC, gets significant economic benefit from it, or holds 25% or more of its ownership interest. Armed with this information, FinCEN hopes to reduce financial crimes like money laundering by making it more difficult for groups to hide illegal activities behind shell corporations. As a result, failing to file has significant civil and criminal penalties.

Filing your BOI report is free, and relatively simple: just file the report online with FinCEN, or upload a PDF to their website. Just be sure to file on time. If you organized in 2024, the report is due within 90 days of getting Vermont’s approval for your Articles of Organization. For LLCs formed in 2025 (or later), that timeline drops to 30 days. Any LLCs that started before 2024 have until January 1, 2025.

You can learn more about the BOI report procedures on FinCEN’s website. Or if you’d like help with this filing, check out our BOI filing report service.

Steps to Take After Forming Your Vermont LLC

After establishing your Vermont LLC, several important steps must be taken to ensure your business is fully operational and compliant with state regulations.

Getting Business Licenses and Permits

Your Vermont LLC may require specific business licenses and permits depending on its industry and location. It’s vital to research and obtain the necessary permits to operate legally within the state.

For example, Vermont doesn’t have a general business license at the state level, but there’s a chance that your city or county might require one.

There are also industry-specific permits that might apply to your business. These can come at the federal, state, or even local levels. While we can’t list all the requirements, here are some common ones:

- Federal licenses: Agriculture, alcoholic beverage sales, aviation, firearms, ammunition, explosives, fish and wildlife, commercial fisheries, maritime transportation, mining and drilling, nuclear energy, radio and TV broadcasting, and transportation and logistics

- State industry licenses: Vermont regulates a wide variety of professional licenses, from acupuncture and accountancy to medicine and tattooing and more. For a fuller look at Vermont’s licensed professions, check out the Vermont Office of Professional Regulation.

Of course, this isn’t an exhaustive list, and ultimately, it’s your responsibility to ensure that your business has all the required permits. If researching the requirements sounds overwhelming, our business license report can help streamline this process for you.

Setting Up an Accounting System

Implementing a reliable accounting system is crucial for managing finances, tracking expenses, and preparing for tax filings. This system will help you maintain financial order and clarity for your LLC.

There are lots of different options available for accounting: a spreadsheet, accounting software, hiring a professional, or even using ZenBusiness Money. What matters most is that you pick a system that works for you and use it faithfully.

Opening a Business Bank Account

Creating a separate bank account for your LLC is important to maintain a clear distinction between personal and business finances. This is essential for financial organization and enhances the credibility of your business.

When you apply for a business bank account, you might be asked to provide documentation such as your EIN, your Articles of Organization, or your operating agreement. Consult with your financial institution for a full list of the documentation you need to provide.

Staying Informed About Legal Requirements

It’s crucial to stay informed about ongoing legal and tax obligations in Vermont; rules are subject to change at any time. For example, you’ll need to file your Vermont annual report every year. Vermont requires a simple informational report to be submitted to the Secretary of State. It’s due every year between January 1 and April 1, and there’s a $35 filing fee (as of this writing).

Next, if your business requires any licenses, you’ll need to renew those, too. But these aren’t the only requirements you might face. Regularly check for updates on state laws and ensure that your LLC remains compliant with all regulatory requirements.

Correcting Filing Mistakes

If there are errors in your LLC’s filing documents, such as in the Articles of Organization, don’t panic. Mistakes can be corrected by filing the Articles of Correction with the Vermont Secretary of State. This process involves specifying the incorrect information and providing the correct details.

Submitting this document along with the $25 filing fee is necessary to maintain the accuracy of your LLC’s official records. After you file this form, the Secretary of State will correct the information that’s on the public record.

Dissolving Your Vermont LLC

To dissolve an LLC in Vermont, a formal process must be followed. This typically starts with an agreement or decision to dissolve, outlined in the LLC’s operating agreement. You will then need to settle any outstanding debts and distribute remaining assets among members. Finally, you’ll need to file the Articles of Termination with the Vermont Secretary of State to formally conclude your LLC’s legal existence.

Ensuring all business and tax affairs are properly concluded is crucial for a seamless dissolution process. For more details on how to complete this process, check out our guide to dissolving a Vermont business.

Choosing the Right Structure: Alternatives to a Vermont LLC

If you’re not 100% sure that an LLC is right for you, don’t worry; there are alternative business structures. Let’s chat through the advantages and disadvantages of each business entity type.

- Sole proprietorship: A sole proprietorship is owned and directed by a single person. It’s an unincorporated business entity, so even though it’s easy to set up (no formal paperwork required), it doesn’t have any personal asset protections.

- Partnership: Like a sole proprietorship, a partnership is an unincorporated business entity with minimal registration requirements and no limited personal liability. However, a partnership is owned and operated by two or more individuals.

- Corporation: A corporation is a registered business entity owned by shareholders and governed by a board of directors. Like LLCs, they offer personal asset protection. But they also offer more opportunities to raise capital, since corporations can sell shares of stock. Compared to an LLC, corporations have more stringent paperwork and recordkeeping requirements and ongoing maintenance tasks.

For many business owners, an LLC strikes a nice balance of easy operation and limited personal liability. That said, if you’re not sure which business structure is best for you, we highly recommend chatting with a business attorney. They’ll give you custom advice for your unique business and goals.

Need help forming your LLC in Vermont?

Once you’ve finished the steps above, you’re (literally) in business! You’ve taken the first steps toward building your dream company. But there’s a lot more to know than just how to start an LLC in Vermont.

You need to know about things like hiring employees, getting business licenses and permits, getting additional financing if you need it, how to make changes in your business, and how to stay in compliance with the government.

Our many services can not only help you form your LLC (our LLC formation service starts at $0), but our business experts can also give you long-term business support to help start, run, and grow your business.

We’ll be with you all the way, whether you’re starting a vintage clothing shop in South Burlington or a moving company in Essex. Reach out to us to learn more about what we can do for you.

VT LLC FORMATION THAT’S FAST AND SIMPLE

Take it from real customers

Vermont LLC FAQs

-

The fee for starting an LLC in Vermont is $125. Fees can change over time, so confirm with the Vermont Secretary of State. There may be other costs depending on additional state services you want, such as a business name reservation or an assumed name.

-

LLCs combine the liability protection of a corporation with the tax savings of a sole proprietorship. These features make them very popular with both new and experienced business owners. Some key LLC benefits include:

- Protection (in most cases) of your personal assets from the liabilities of your business and collections on business debt

- Flexible management and ownership structures tailored to your desires

- Few maintenance requirements, and only a $45 Vermont annual fee (as of this writing) for filing your annual report

- Flexible taxation options to suit your business goals

-

Federal Taxes

By default, LLCs are taxed as pass-through entities, meaning the owners pay income taxes at the individual level instead of the business paying taxes at the company level. So when tax time comes, the LLC members will fill in IRS Form 1040, reporting their share of the LLC’s income there. If the LLC has more than one member, the business will file an informational return with the Internal Revenue Service as well.As part of this process, each member will likely pay self-employment taxes (taxes for Social Security and Medicare) on their share of the income. Electing S corporation or C corporation status can help reduce tax burdens, so talk with a tax professional if you’re considering these statuses. You can also learn more in our S corporation guide.

Vermont Taxes

Vermont mirrors your federal tax structure for income taxes. That said, there are additional taxes you’ll need to pay:- The business entity income tax (minimum of $250, charged regardless of structure)

- State employer taxes (if you have employees)

- State sales tax (if you sell goods)

- State unemployment tax (if you have employees)

- Taxes related to certain products (such as liquor or tobacco)

- Taxes for using certain minerals or other public resources

In addition to the above taxes, you might need to pay taxes based on your city. Check your municipal website for more information. To better understand your state tax burden, visit the VT Department of Taxes website for more information. Also, consult a tax professional.

-

When filing online, it normally takes one business day to confirm your filing. If you choose to file by mail, it can take approximately 7-10 business days, not counting the time in transit.

-

No, you don’t need to file your LLC’s operating agreement with the state or any government agency. It’s an internal document for your LLC.

-

No, Vermont state law doesn’t permit the Series LLC business structure. A Series LLC is one in which several separate LLCs operate under one LLC entity.

-

If you want to dissolve your business, you’ll need to file the Articles of Dissolution with the Vermont Secretary of State. First, you’ll need to pay off any business debts, sell off assets, and distribute any remaining profits among the members. Your operating agreement can provide a clear roadmap and instructions in the case of dissolution. In the absence of an operating agreement, VT’s LLC laws will determine how your LLC will be dissolved. To learn more, see our page on Vermont business dissolution.

-

The process for transferring ownership of your Vermont LLC is typically in your operating agreement. You’ll likely need a purchase agreement where the previous owner sells their LLC interests to the buyer. Next, the Articles of Organization are amended to reflect the change in ownership. You’ll want to file these amended Articles of Organization with the state.

The process for removing a member is very similar.

-

Yes. Visit the Assumed Business Name Registration page on the Vermont Secretary of State website and follow the instructions there. You’ll also need to pay a filing fee.

-

Yes, Vermont requires LLCs to file an annual report. You’ll need to file through the Secretary of State’s online system and pay a $45 fee.

-

You’re not legally required to have a business plan to form your LLC, but having a business plan can put you ahead of the game. A good plan contains information on the business’s founders, market research, and potential financing sources. Having a business plan can make your business more attractive to potential investors as you navigate the start-up period.

Disclaimer: The content on this page is for information purposes only and does not constitute legal, tax, or accounting advice. If you have specific questions about any of these topics, seek the counsel of a licensed professional.

ZenBusiness is a financial technology company and is not a bank. Banking services provided by Thread Bank, Member FDIC. The ZenBusiness Visa Debit Card is issued by Thread Bank pursuant to a license from Visa U.S.A. Inc. and may be used anywhere Visa debit cards are accepted. FDIC insurance is available for funds on deposit through Thread Bank, Member FDIC.

*Your deposits qualify for up to a maximum of $3,000,000 in FDIC insurance coverage when placed at program banks in the Thread Bank deposit sweep program. Your deposits at each program bank become eligible for FDIC insurance up to $250,000, inclusive of any other deposits you may already hold at the bank in the same ownership capacity. You can access the terms and conditions of the sweep program at https://go.thread.bank/sweepdisclosure and a list of program banks at https://go.thread.bank/programbanks. Please contact customerservice@thread.bank with questions regarding the sweep program.

LLC Formation States Near Vermont

Ready to Start Your LLC?